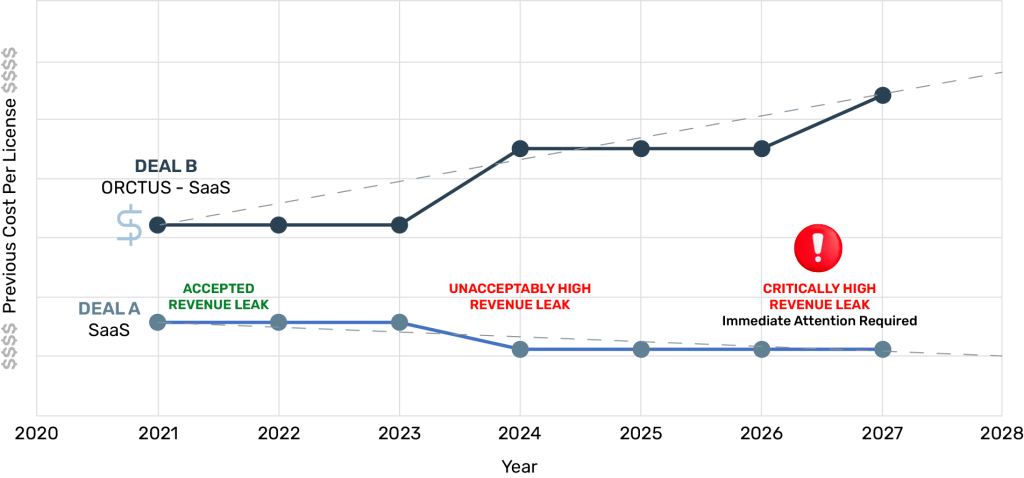

This case study explores how strategic pricing outperformed sheer license volume to drive profitability and sustainable growth. By analyzing two deals—one prioritizing volume and the other focusing on value—we uncover critical insights on aligning pricing models with business goals. See how Deal B’s dynamic approach ensured long-term success, while Deal A’s underpricing led to significant revenue leakage.

Revenue Loss Comparison

While Deal A benefits from having twice as many licenses as Deal B, this volume advantage does not translate into better overall profitability for the company. A deeper analysis reveals that the pricing structure and long-term revenue leakage in Deal A significantly undermine its potential, highlighting the importance of strategic pricing over sheer volume.

Revenue Generation in Deal A

Volume Vantage

Deal A’s higher number of licenses initially seems like a clear benefit. However, this advantage is offset by a significantly lower per-license price, especially post-2023. While the company may generate more revenue due to the higher license count, this revenue fails to reflect the true value of the product.

Revenue Shortfall

For instance, even with twice the number of licenses, the underpricing in Deal A leaves substantial money on the table. By 2024, the impact of this underpricing becomes apparent, as profit margins are significantly eroded. For example, assuming Deal A has 200 licenses and Deal B has 100, Deal A generates 200 × $X = $XX in 2024. In contrast, Deal B, with higher pricing, generates 100 × $Y = $YY. Despite having double the licenses, Deal A’s total revenue is outpaced by Deal B, and the disparity only grows as Deal B’s pricing escalates over time.

Revenue Generation in Deal B

Strategic Pricing

Deal B’s higher per-license pricing ensures stronger initial revenue generation despite its smaller volume. Over time, incremental price increases in Deal B amplify this advantage, leading to exponential revenue growth.

Long-Term Gains

By 2024, while Deal A remains constrained by low pricing, Deal B benefits from a price increase per license. For instance, with fewer licenses, Deal B still generates substantially higher revenue due to its strategic pricing model. By 2027, the per-license price in Deal B reaches $XX, yielding significant profitability gains even with fewer licenses.

Profitability Analysis

Deal A

The high volume of licenses in Deal A may initially create an illusion of profitability. However, the substantially lower per-license revenue erodes profit margins, leaving the company vulnerable to revenue leakage. This underpricing forces the company to either cut costs, compromise service quality, or attempt to raise prices—all of which carry significant risks.

Deal B

In contrast, Deal B’s pricing model prioritizes profitability over volume. The higher per-license revenue and incremental price increases ensure sustained growth and stronger margins. This approach not only drives profitability but also aligns with the company’s long-term strategic goals.

Key Takeaways

Volume

vs. Price

While Deal A benefits from higher license volume, its low pricing results in significant revenue leakage and lower profitability. Deal B demonstrates that fewer licenses with higher pricing can deliver better financial outcomes.

Long-Term

Profitability

Deal A’s stagnant pricing locks the company into suboptimal profit potential, whereas Deal B’s dynamic pricing model ensures continued revenue growth and robust margins.

Sustainable Business Model

Deal A’s reliance on volume without corresponding revenue growth jeopardizes its sustainability. Deal B’s strategic pricing approach provides a scalable and profitable solution.

Conclusion

While Deal A may generate higher total revenue in the short term due to its larger license volume, Deal B’s pricing strategy delivers superior profitability and sustainable growth. For the company to maximize its SaaS product’s value, it must prioritize pricing strategies that reflect the service’s true worth. By focusing on value capture rather than volume, the company can ensure long-term success and a stronger competitive position. Deal B’s approach is a clear model for achieving these goals.

Unlock Your Revenue Potential Today

Let Orctus transform the way you approach high-stakes sales

Explore our packages to see how we can help your organization reclaim lost revenue, close with confidence, and drive sustainable growth.